PA DEX 93 2023-2024 free printable template

Show details

IMPORTANT: FILL IN FORM MUST BE DOWNLOADED ONTO YOUR COMPUTER PRIOR TO COMPLETING

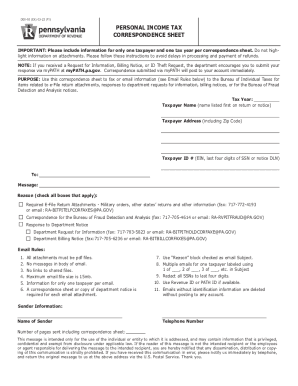

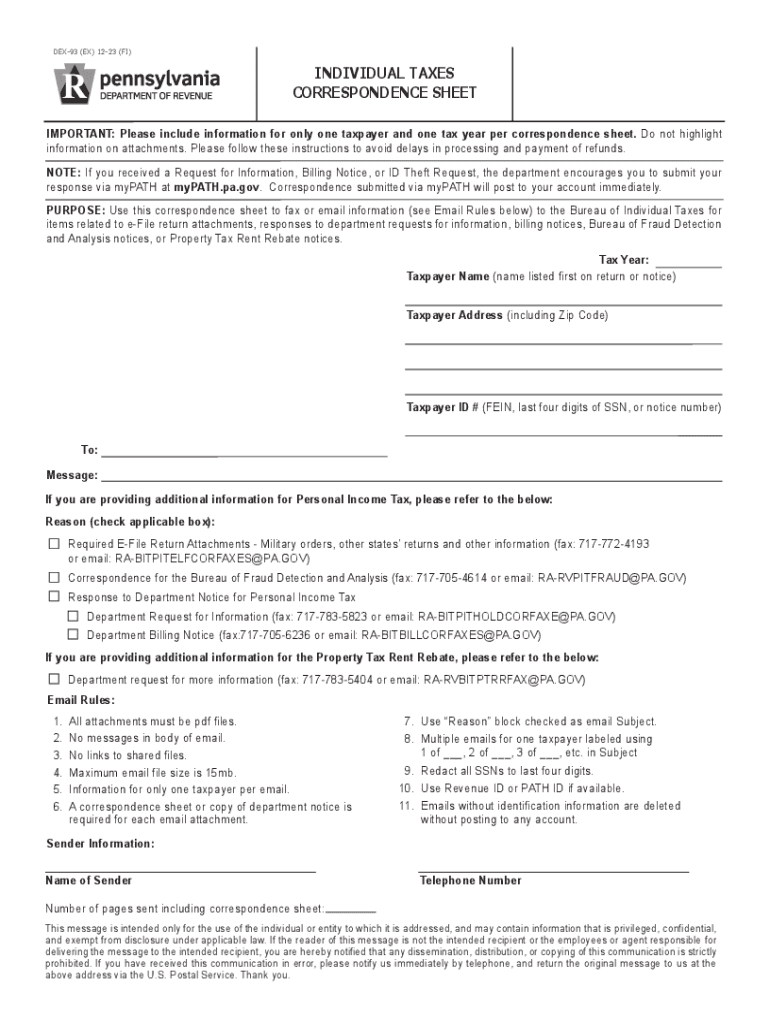

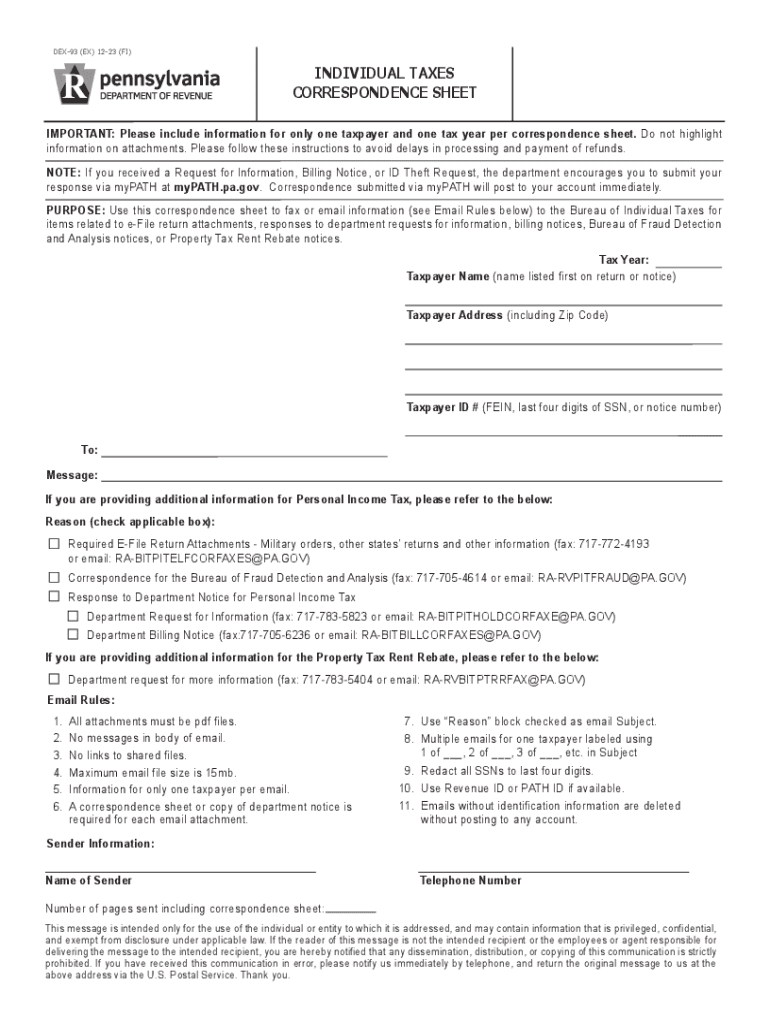

DEX93 (EX) 1223 (FI)IndIvIdual Taxes

CORResPOndenCe sHeeTOFFICIAL USE ONLYIMPORTANT: Please include information for

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your dex 93 2023-2024 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dex 93 2023-2024 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit dex 93 online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit dex 93 form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

PA DEX 93 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out dex 93 2023-2024 form

How to fill out personal income tax correspondence

01

Gather all necessary documents such as W-2 forms, 1099 forms, and receipts.

02

Determine your filing status (single, married filing jointly, etc.)

03

Calculate your total income by adding up all sources of income.

04

Look for deductions and credits that you may be eligible for. These can include education expenses, home office deductions, and retirement contributions.

05

Fill out the appropriate tax forms such as Form 1040 or 1040EZ. Be sure to include all your income and deductions accurately.

06

Double-check all calculations and make sure all necessary information is included.

07

Sign and date the tax return.

08

File the tax return by mailing it to the designated tax office or e-filing it online.

09

Keep a copy of your tax return and supporting documents for your records.

Who needs personal income tax correspondence?

01

Anyone who has earned income during the tax year needs to fill out personal income tax correspondence. This includes individuals who are employed, self-employed, or receive income from investments or other sources. It is a legal requirement to report your income and pay taxes accordingly.

Fill pennsylvania dex 93 : Try Risk Free

People Also Ask about dex 93

What is a DEX 93?

How do I get my PA 40 form?

How do I get a copy of my PA-40?

Where can I get a hard copy 1040?

What is a PA 40 tax form?

Does everyone have to fill out a 10/40 form?

How do I get a PA 40 tax form?

Where to send correspondence to the PA Department of Revenue?

Who must file PA 40?

How do I appeal a PA Department of Revenue?

Who files a PA-40 form?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is personal income tax correspondence?

Personal income tax correspondence refers to the communication and documentation related to the filing and reporting of an individual's personal income taxes.

Who is required to file personal income tax correspondence?

Any individual who has an income above a certain threshold set by the tax authority is required to file personal income tax correspondence.

How to fill out personal income tax correspondence?

To fill out personal income tax correspondence, individuals need to gather relevant financial information, such as income statements, deductions, and credits. They must then accurately complete the required forms or use electronic filing software.

What is the purpose of personal income tax correspondence?

The purpose of personal income tax correspondence is to fulfill the legal obligation of reporting and paying income tax on an individual's earnings to the tax authority.

What information must be reported on personal income tax correspondence?

Personal income tax correspondence requires reporting various details, including income sources, deductions, credits, and any additional information specified by the tax authority.

When is the deadline to file personal income tax correspondence in 2023?

The deadline to file personal income tax correspondence in 2023 will be determined and announced by the tax authority. Please refer to their official guidelines and announcements for the specific deadline.

What is the penalty for the late filing of personal income tax correspondence?

The penalty for late filing of personal income tax correspondence can vary depending on the jurisdiction and the specific circumstances. It may include financial penalties, interest charges, or other consequences as defined by the tax authority. It is advisable to consult the tax authority's guidelines or seek professional advice for accurate information.

Can I create an electronic signature for signing my dex 93 in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your dex 93 form and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I fill out the pa form dex 93 form on my smartphone?

Use the pdfFiller mobile app to fill out and sign pa dex 93. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How can I fill out dex93 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your tax payment form. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Fill out your dex 93 2023-2024 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pa Form Dex 93 is not the form you're looking for?Search for another form here.

Keywords relevant to income fax cover form

Related to pa cover sheet

If you believe that this page should be taken down, please follow our DMCA take down process

here

.